Industry News

08.11.2021

Relentless Supply Chain Disruptions: Global Manufacturing Hubs Brace for Impact

As companies and manufacturers look ahead to 2022, the market behavior and events that have disrupted the supply chain in recent months indicate a rocky road ahead.

Industry News

08.3.2021

Why an Open Market Distributor is Vital to Supply Chain Strategy

In the wake of fast-paced technological advancements, the open market has become a vital link in the global supply chain for when demand exceeds supply.

Industry News

07.1.2021

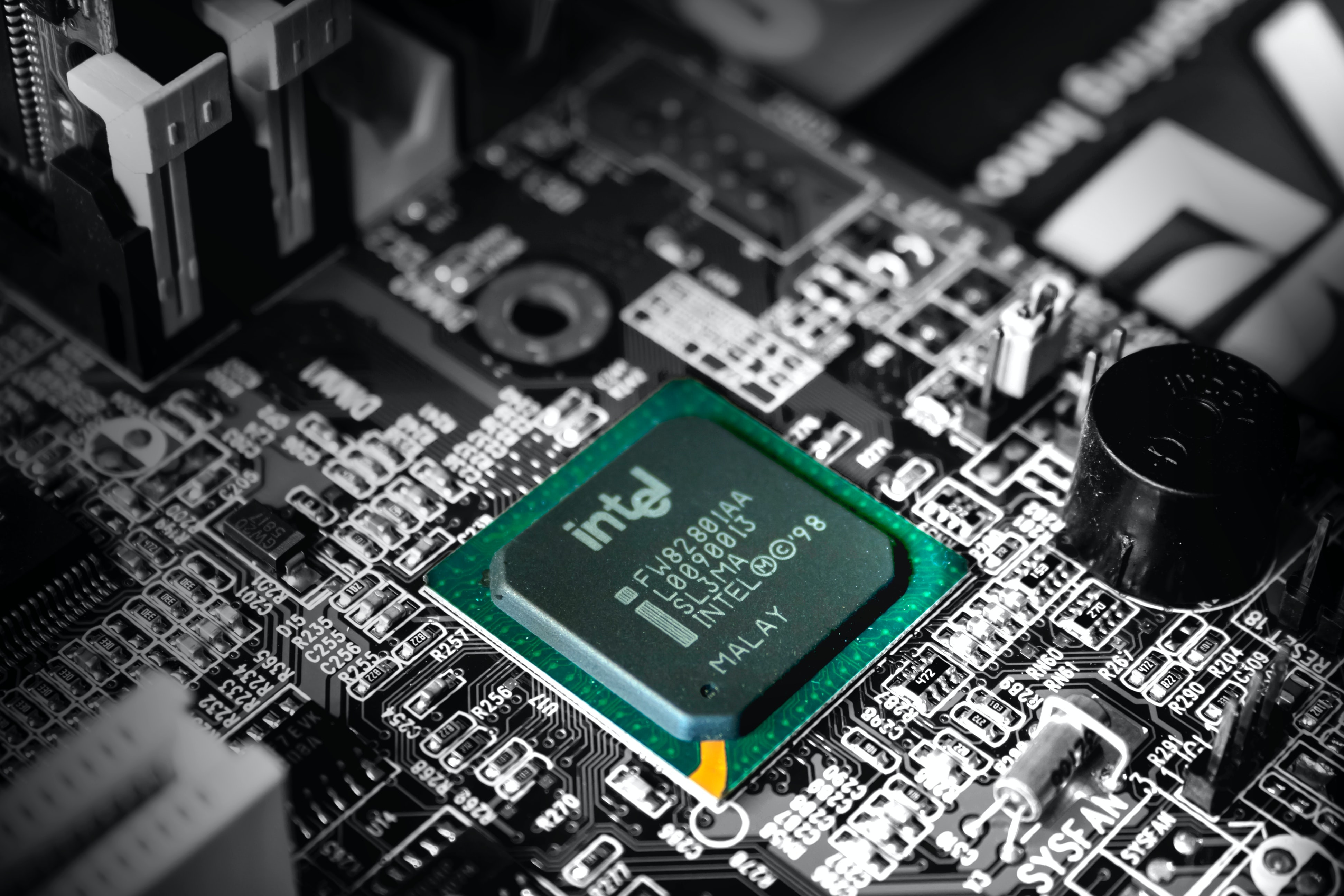

Delayed CPU Production Could Hinder Intel’s Mission to Regain Market Share

Just as Q3 2021 started, Intel CVP Lisa Spelman announced the production of its latest component, the Sapphire Rapid CPU, had been delayed.

Industry News

06.30.2021

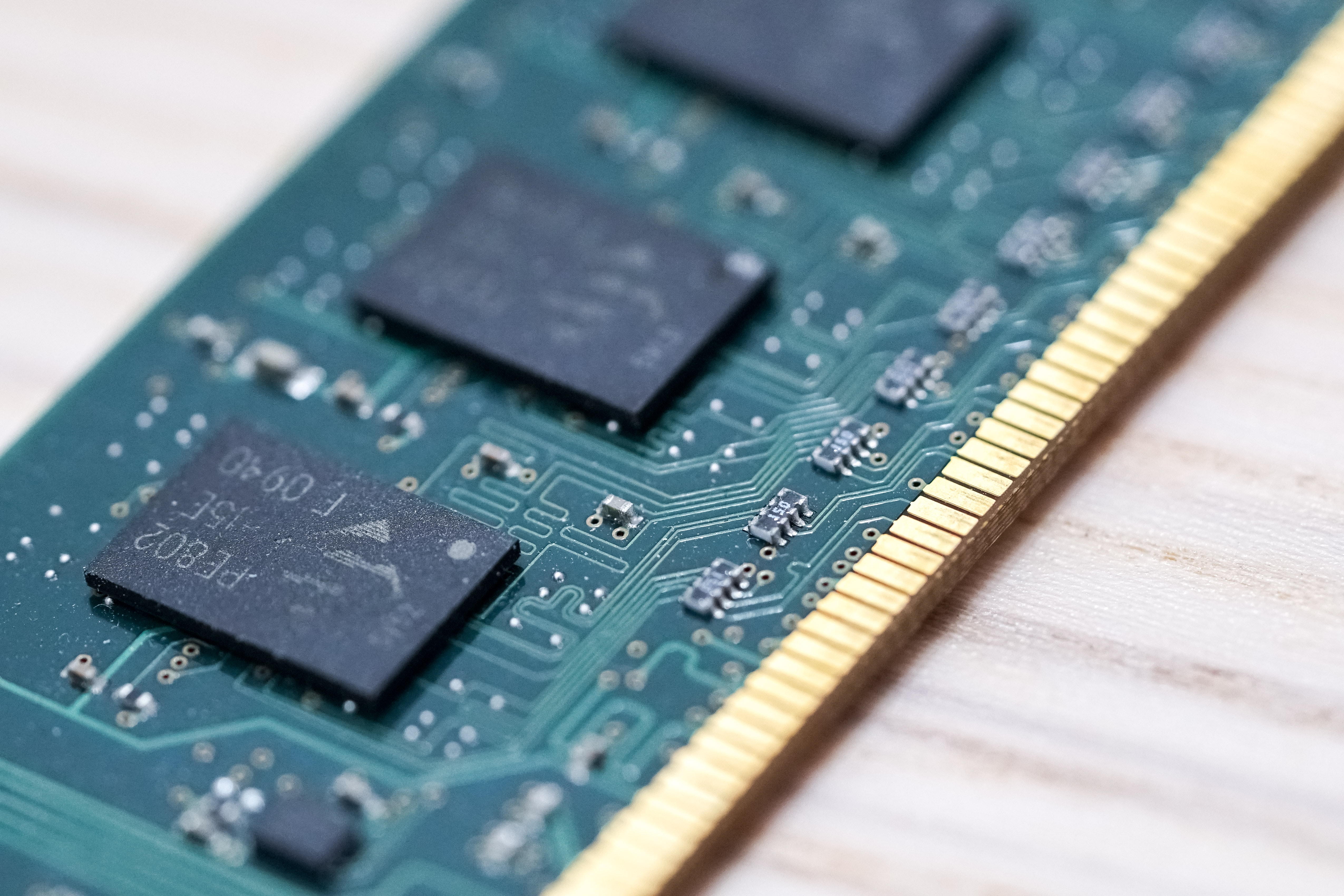

The Memory Market – More Hurdles to Jump Over in Q3 and Beyond?

The memory chip sector has a long list of pain points that factor into its unpredictable future in the next quarter and beyond. Some market trends indicate demand will soften, while others show if the previous climate is any indication, then shortages could persist through 2022.

Industry News

05.12.2021

Technology Sector Leads Market Plummet Amid Fear of Inflation

The volatility of the semiconductor industry is extending to Wall Street and international trading markets. With chip shortages worsening due to unprecedented events and increased consumer demand, inflation fears are mounting for investors.

Industry News

04.23.2021

Regulatory Approval of SK Hynix Acquisition of Intel's NAND Business Progresses

The SK Hynix acquisition of Intel’s NAND storage and memory business receives approval from US. The EU has set its regulatory review deadline for May 20.

Industry News

04.20.2021

New Blockchain, Chia, Increases Global Demand for Server Components

Demand for SSD, HDD, GPU and CPU components is increasing as the market responds to new blockchain cryptocurrency Chia.

Industry News

03.22.2021

Fire at Renesas Plant Affects Supply of Automotive Chips, MOSFETs and More

A fire is the second disaster to disrupt production at the Renesas Naka factory in Japan in 2021, affecting supply of automotive and nonautomotive chips

Industry News

03.19.2021

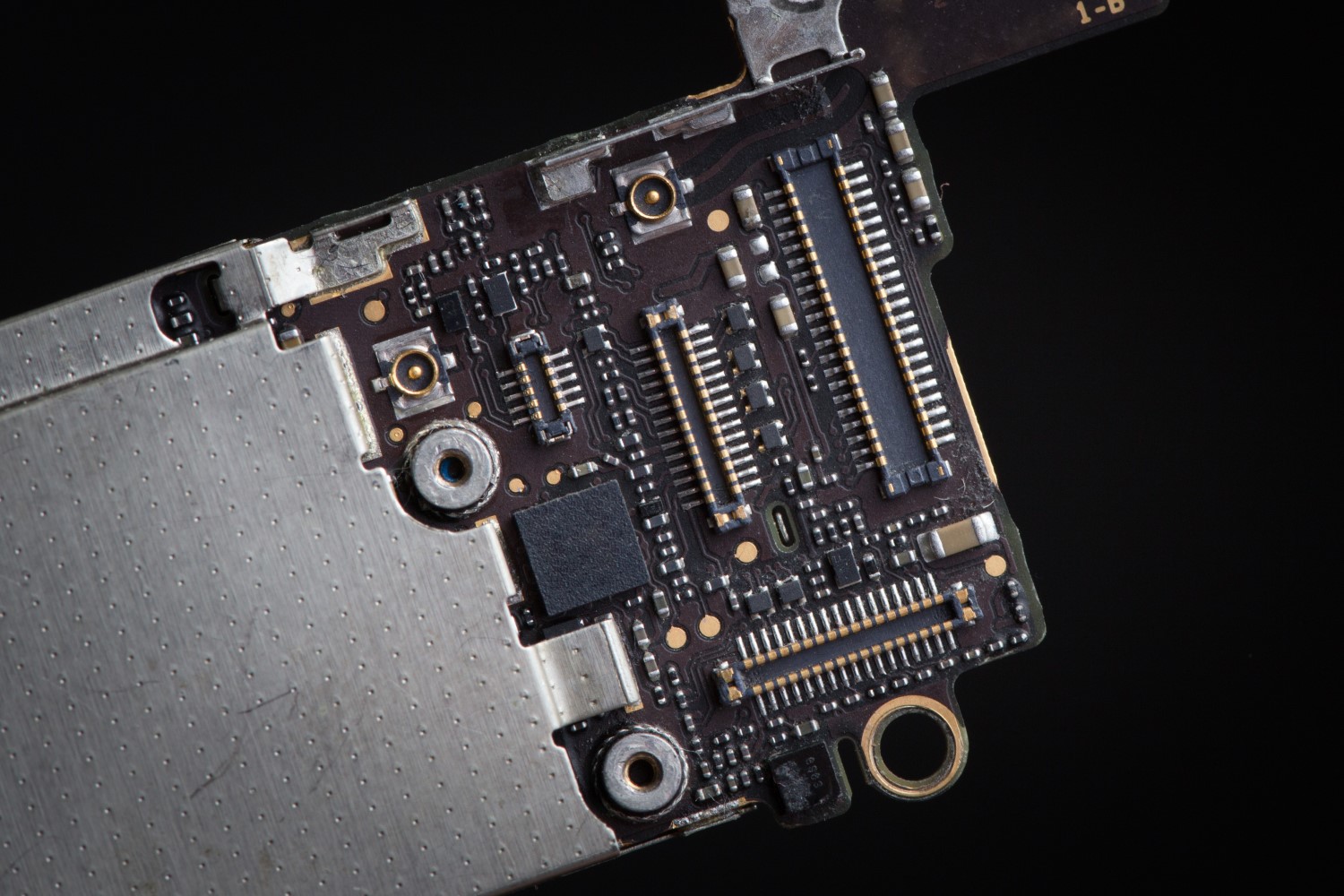

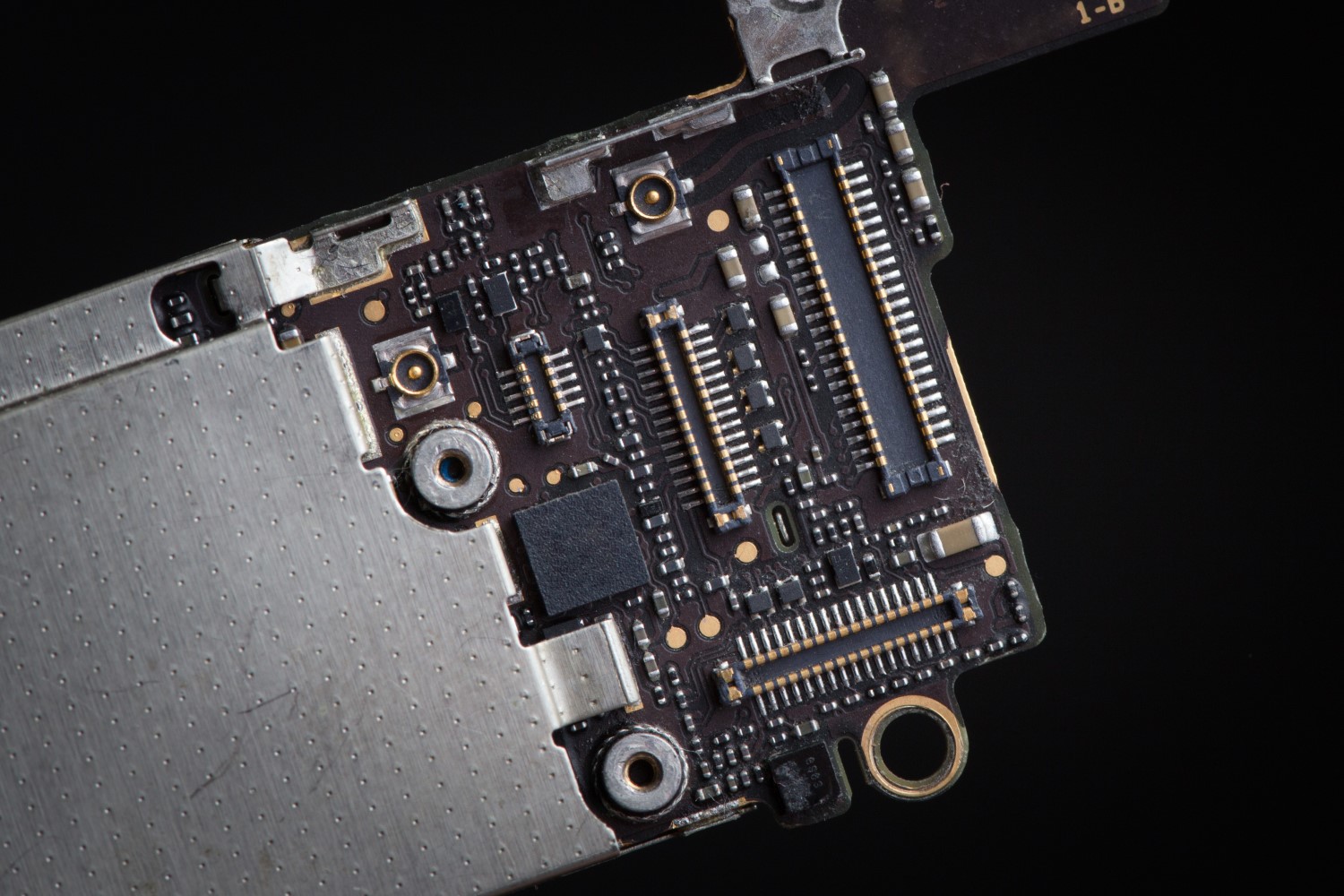

Embedded Multimedia Card Supply Tightens with NAND Flash Market

For SSDs and eMMCs in particular, NAND Flash is affecting pricing and supply. eMMC products under 32GB feature 2D NAND or 64L 3D NAND prices are increasing

Industry News

03.2.2021

US Government to Assess Supply Chain Weaknesses

US President Biden signed an executive order aimed to assess the country’s supply chain weaknesses to avoid shortages from PPE to semiconductors.